Erfolgreich! Dein Termin wurde gebucht

Nächster Schritt: Schau dir das kurze 5-Minuten-Video unten an 👇.

Was du erwarten kannst:

Was du erwarten kannst:

- Dein Zoom-Link wird dir 10 Minuten vor Beginn deines Gesprächs per E-Mail zugeschickt - Bitte bring einen Stift und ein Blatt Papier mit, damit du dir Notizen machen kannst - Bitte nimm das Gespräch an einem ruhigen Ort war

- Dein Zoom-Link wird dir 10 Minuten vor Beginn deines Gesprächs per E-Mail zugeschickt - Bitte bring einen Stift und ein Blatt Papier mit, damit du dir Notizen machen kannst - Bitte nimm das Gespräch an einem ruhigen Ort war

Bitte nicht :

Bitte nicht:

- Nimm den Zoom-Termin nicht über ein Handy, im Auto, auf dem Flughafen usw. entgegen.

- Nimm den Termin nicht bei der Arbeit, in der Mittagspause usw. entgegen.

- Nimm den Termin nicht in einer lauten Umgebung entgegen

- Nimm den Zoom-Termin nicht über ein Handy, im Auto, auf dem Flughafen usw. entgegen.

- Nimm den Termin nicht bei der Arbeit, in der Mittagspause usw. entgegen.

- Nimm den Termin nicht in einer lauten Umgebung entgegen

Wichtig !

Wichtig!

Vor dem Termin, scroll diese Seite durch !

Vor dem Termin, scroll diese Seite durch!

- Marc tradet Live mit den mechanischen Regeln

- Statistische Beweise, dass die Regeln funktionieren

- Häufig gestellte Fragen

- Ergebnisse unserer Trader

- Marc tradet Live mit den mechanischen Regeln

- Statistische Beweise, dass die Regeln funktionieren - Häufig gestellte Fragen - Ergebnisse unserer Trader

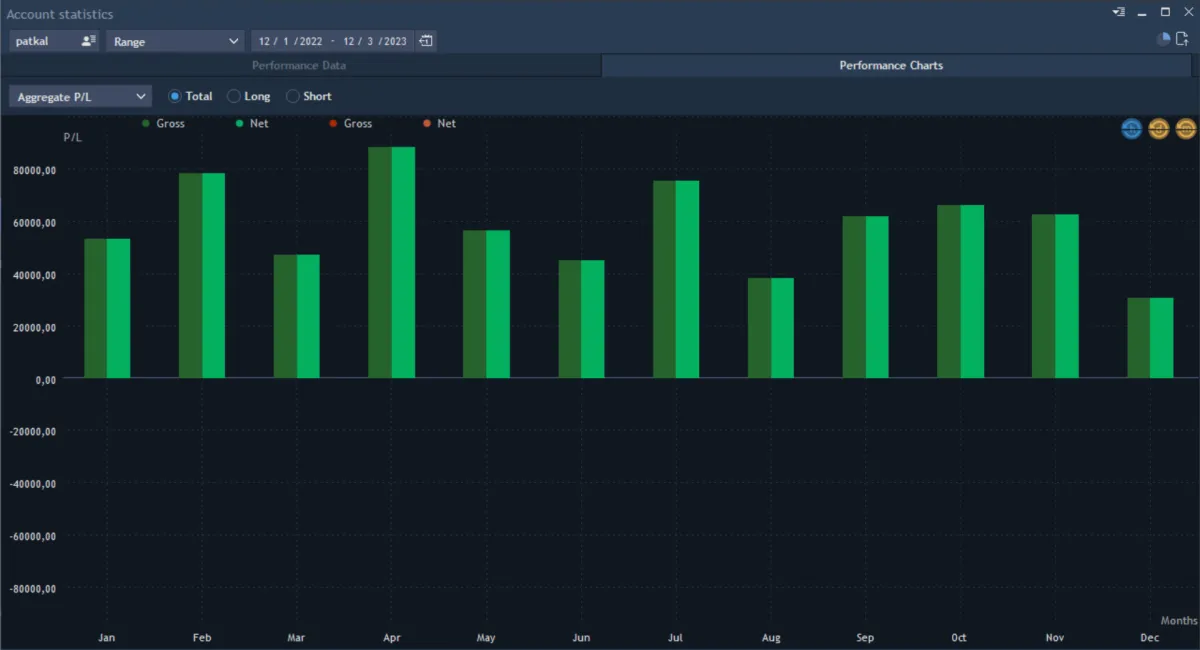

"Bei Heldental fand ich meine Berufung im Daytrading." - Patrick

Patrick Kaldasch – Düsseldorf, DE

Problem:

Patrick, ein ehemaliger Mathematikstudent, hatte schon immer den Wunsch, selbstständig und selbstbestimmt zu arbeiten. Seine Begeisterung für Fußball in der Kindheit fand er in keinem anderen Bereich wieder, bis er auf das Thema Daytrading stieß. Trotz seines Studiums fühlte er, dass ein gewöhnlicher Nine-to-Five-Job nicht das Richtige für ihn war. Er suchte nach einer Möglichkeit, seine Leidenschaft für Trading zu verfolgen, ohne in die Falle eines routinemäßigen Berufslebens zu geraten.

Lösung:

Bei Heldental fand Patrick die Möglichkeit, seine Träume zu verwirklichen. Er erhielt die notwendige Unterstützung und vor allem die Zeit, sich zu entwickeln. Anfangs musste er Nachtschichten in einem anderen Job machen, um tagsüber Zeit für das Daytrading zu haben. Diese Phase ermöglichte es ihm, sich voll und ganz auf das Trading zu konzentrieren und gleichzeitig ein Einkommen zu sichern.

Ergebnis:

Mittlerweile verwaltet Patrick ein Trading-Konto in Höhe von zwei Million und ist seinem Mentor bei Heldental dankbar für die richtige Anleitung und Unterstützung. Er betont, dass es ihm bei Heldental gelungen ist, seinen eigenen Trading-Stil zu finden und diesen mit seiner Persönlichkeit zu vereinen, was er als entscheidend für langfristigen und konstanten Handelserfolg sieht. Für diese Entwicklung ist er Heldental sehr dankbar.

Aktuelle Performance 2023:

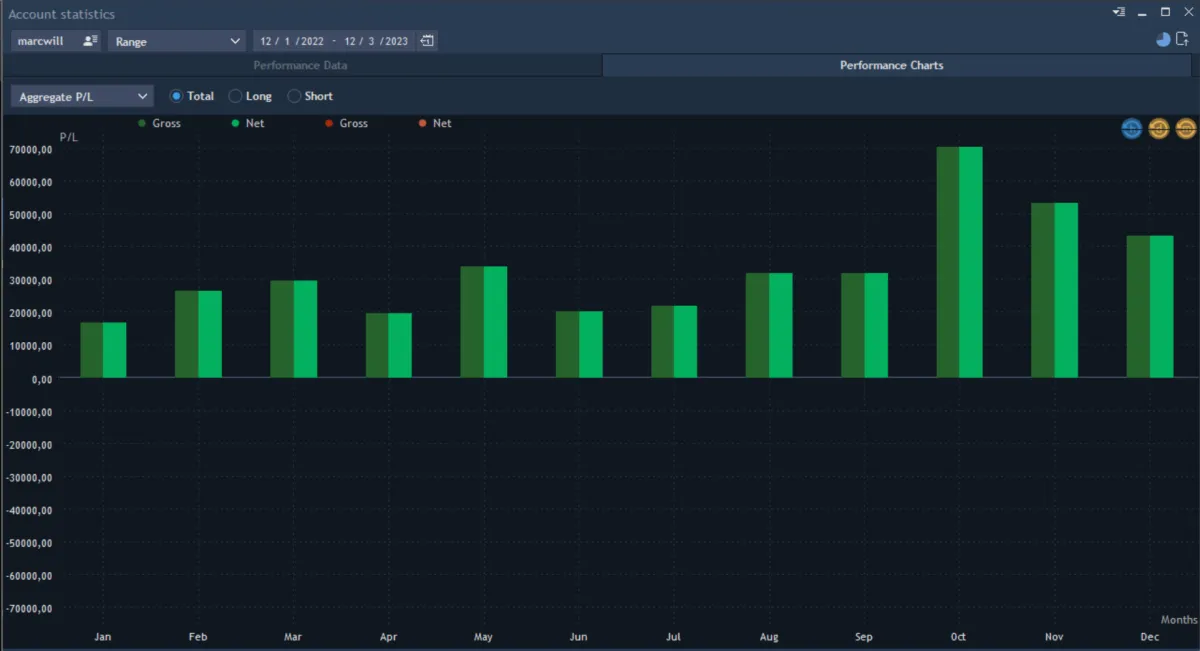

"Von einem kleinen Konto zu einem Top Trader bei Heldental – ein Traum wurde wahr." - Marc Willmann

Marc Willmann – Köln, DE

Problem:

Marc Willmann, ursprünglich Student aus Freiburg im Breisgau, hatte große Ambitionen, aber fand im Studium der Umweltingenieurwissenschaften nicht die ersehnte Begeisterung. Sein Hauptproblem war ein Mangel an Leidenschaft und Zufriedenheit in seiner beruflichen Laufbahn. Zusätzlich war er als Student mit dem Problem konfrontiert, dass er nicht genügend Kapital hatte, um effektiv zu traden. Sein erstes Trading-Konto war auf nur 100 Euro beschränkt, was nicht ausreichte, um seinen Traum vom professionellen Trading zu verwirklichen.

Lösung:

Marc's Interesse für das Trading wurde durch einen Film geweckt, und er begann, sich intensiv mit dem Thema zu beschäftigen. Trotz Selbststudiums stieß er jedoch auf Grenzen. Die Lösung fand er bei Heldental, wo er durch das Trader Premier Programm seine Probleme schnell überwinden konnte. Heldental bot ihm eine umfangreiche Ausbildung, effektive Strategien und die Möglichkeit, durch Skalierungsstufen sein Kapital zu erhöhen.

Ergebnis:

Durch die Zusammenarbeit mit Heldental konnte Marc sein Fachwissen erweitern, profitabel traden und schließlich seinen Nebenjob kündigen, um Vollzeit-Trader zu werden. Dieser Übergang war zwar mit Ängsten und Unsicherheiten verbunden, aber mit der Unterstützung von Heldental gelang ihm der Schritt reibungslos. Heute reflektiert Marc, dass die Zusammenarbeit mit Heldental sein Leben positiv verändert hat und er nun in der Lage ist, anderen angehenden Tradern bei Heldental zu helfen, denselben Erfolg zu erreichen.

Aktuelle Performance 2023:

"Heldental verwandelte mein planloses Trading in eine Erfolgsgeschichte."

- Matthias

Problem:

Matthias, ein Vertriebsmitarbeiter aus einem kleinen Dorf in Bayern, stand vor großen Herausforderungen im Bereich des Tradings. Sein Ansatz war planlos; er versuchte, Trends zu folgen und daraus Profit zu schlagen, jedoch mit mäßigem Erfolg. Die Hauptprobleme waren die Auswahl der richtigen Aktien und die Unsicherheit darüber, ob er gute Trades machte oder nicht. Trotz Selbststudiums und der Suche nach Lösungen im Internet fand er keinen Weg, der ihm Sicherheit und Erfolg im Trading bot.

Lösung:

Matthias entdeckte das Programm von Heldental, angezogen durch positive Rezensionen und die Seriosität des Angebots. Heldental bot ihm die Möglichkeit, mit einem Startkapital zu beginnen, sich mit anderen Tradern auszutauschen und von erfahrenen Coaches zu lernen. Das Programm versprach effektive Strategien, Vorlagen und zentrale Informationen, die Matthias dabei helfen sollten, erfolgreich zu traden.

Ergebnis:

Durch das Programm von Heldental konnte Matthias nicht nur Geld verdienen, sondern auch Zeit sparen. Er startete mit einem $10.000 Trading-Konto und konnte dieses in kurzer Zeit schon auf etwa $11.600 steigern, ohne Drawdown. Besonders profitierte er vom Live Trading und dem Austausch mit den Coaches, deren Konstanz und Profitabilität ihn beeindruckten. Matthias' Ratschlag an andere ist, am Ball zu bleiben und die qualitativ hochwertigen Informationen von Heldental zu nutzen, um profitabel zu handeln. Er empfiehlt Heldental weiter und schätzt die Möglichkeit, mit einem größeren Depot zu starten und den Zusammenhalt unter den Tradern.

Aktuelle Performance 2023:

"Dank Heldental wechselte ich vom Gelegenheitstrader zum Profi." - Timo

Problem:

Timo, ein Production Manager aus der Nähe von Nürnberg und Vater von zwei Töchtern, hatte nur geringe Erfahrungen im Trading. Seine Versuche, über verschiedene Apps und Plattformen zu handeln, waren nicht erfolgreich. Die größte Herausforderung für ihn war der Mangel an Erfolgen, was zu einer sinkenden Motivation führte.

Lösung:

Timo entschied sich für Heldental, angezogen durch das ansprechende Gesamtpaket und die Hoffnung auf signifikante Verbesserungen in seinem Trading. Heldental machte auf ihn einen sehr seriösen Eindruck, insbesondere durch den persönlichen Kontakt und die erkennbare Professionalität hinter dem Programm. Das umfangreiche Angebot von Heldental, das speziell auf Anfänger im Trading zugeschnitten ist, überzeugte ihn.

Ergebnis:

Der Einstieg bei Heldental war für Timo einfach, unterstützt durch ein gutes Vorgespräch und eine niedrige Einstiegshürde. Das Programm half ihm, schnell und profitabel zu traden, dank der hochwertigen Ausbildung und umsetzbaren Strategien. Timo hebt die Professionalität und Effektivität der Coaches bei Heldental hervor und empfiehlt das Programm weiter. Er ermutigt jeden, der in den Aktienhandel einsteigen möchte, Heldental als beste Anlaufstelle zu betrachten.

Aktuelle Performance 2023:

"Heldental hat mir den Weg zu strukturiertem und erfolgreichem Trading eröffnet." - Waldemar

Problem:

Waldemar Heimann, ein 36-jähriger Hardware-Entwicklungsingenieur aus Regensburg, versuchte zunächst, das Trading im Alleingang zu meistern. Trotz der Nutzung von YouTube-Videos und Büchern fehlte es ihm an einer strukturierten Herangehensweise. Sein Fokus lag auf dem markttechnischen Ansatz und Swingtrades, was jedoch nur in positiven Marktphasen funktionierte. Die größte Herausforderung war das Mindset, besonders nach einem erheblichen Verlust bei einer Investition in Meta, was zu Schock und Handlungsunfähigkeit führte.

Lösung:

Waldemar entdeckte Heldental, die einzige deutschsprachige Prop Trading-Firma, und war sofort von der Offenheit und Transparenz in ihren YouTube-Videos beeindruckt. Das Programm bei Heldental bot ihm ein solides Fundament für das Trading, regelmäßige Meetings und eine starke Community-Unterstützung. Es konzentrierte sich auf den systematischen Aufbau von Wissen und die Minimierung von Risiken.

Ergebnis:

Durch die Teilnahme am Programm von Heldental konnte Waldemar sein Trading signifikant verbessern. Er lernte, mit einer Flut von Informationen umzugehen, seinen Arbeitsbereich effizient zu gestalten und die richtigen Entscheidungen zu treffen. Die Coaches von Heldental beeindruckten ihn mit ihrer Professionalität und Performance. Waldemars langfristiges Ziel ist es nun, finanzielle Freiheit durch Trading zu erreichen. Er empfiehlt das Programm von Heldental weiter und schätzt die familiäre Atmosphäre und die professionelle Unterstützung, die er dort erhält.

Aktuelle Performance 2023:

"Mit Heldental fand ich Klarheit und Struktur in meinem Trading." - Luisa

Problem:

Luisa, eine öffentliche Bedienstete aus Mainz, hatte vor ihrer Zeit bei Heldental mit chaotischem und strukturlosem Trading zu kämpfen. Sie fand keinen klaren Plan oder Ziel für ihr Trading und litt unter dem Fehlen von Regeln und Struktur. Ihre Versuche, auf Demo-Konten zu handeln, waren erfolglos, und sie fühlte sich orientierungslos und unzufrieden mit ihren Trading-Ergebnissen.

Lösung:

Nach einer intensiven Suche und Überprüfung verschiedener Optionen entschied sich Luisa für Heldental. Sie war beeindruckt von der Freundlichkeit der Mitarbeiter, der Offenheit des Konzepts und der Möglichkeit, direkt mit einem Prop-Trading Konto zu handeln. Heldental bot ihr strukturierte Lerninhalte, regelmäßige Live-Tradings und Meetings sowie eine starke Community für den Austausch und Support.

Ergebnis:

Durch das Programm von Heldental konnte Luisa ihre Trading-Fähigkeiten erheblich verbessern. Sie lernte, sich an Regeln zu halten, strukturiert zu arbeiten und effektiv auf dem Markt zu agieren. Mit der Unterstützung von Heldental und der Möglichkeit, jederzeit auf Lerninhalte zuzugreifen, konnte sie ihr Wissen vertiefen und ihre Trading-Strategie verfeinern. Luisa startete mit einem 10.000-Dollar-Konto und konnte dieses bereits um 1.300 Dollar steigern. Sie ist beeindruckt von der Konstanz und Professionalität der Coaches bei Heldental und hat das Ziel, ihre Trading-Fähigkeiten weiter zu entwickeln und die nächste Skalierungsstufe zu erreichen. Luisa ist dankbar für die Unterstützung und das Wissen, das sie bei Heldental erhalten hat, und empfiehlt das Programm anderen, die ihre Trading-Fähigkeiten verbessern möchten.

Aktuelle Performance 2023:

Lerne von einem Händler, der live und in Echtzeit für alle sichtbar handelt:

Lerne von einem Händler, der live und in Echtzeit für alle sichtbar handelt:

Im Gegensatz zu vielen anderen "Tradern" handeln unsere Coaches immer live, vor Publikum Gewinne und Verluste sind für alle sichtbar aufgezeichnet und werden mit anderen geteilt:

Im Gegensatz zu vielen anderen "Tradern" handeln unsere Coaches immer live, vor Publikum Gewinne und Verluste sind für alle sichtbar aufgezeichnet und werden mit anderen geteilt:

Patricks komplette Performance der letzten 2 Jahre

Strategie Webinar mit Patrick

Aber Moment, woher weißt du, dass die mechanischen Regeln wirklich funktionieren?

Aber Moment, woher weißt du, dass die mechanischen Regeln wirklich funktionieren?

Eigentlich ist es ganz einfach. Die überprüfbaren, verifizierbaren Strategiestatistiken beweisen unbestreitbar, dass sie es tun. Sie zeigen jeden einzelnen Trade, der durch die einzelnen Strategien ausgelöst wurde:

Eigentlich ist es ganz einfach. Die überprüfbaren, verifizierbaren Strategiestatistiken beweisen unbestreitbar, dass sie es tun. Sie zeigen jeden einzelnen Trade, der durch die einzelnen Strategien ausgelöst wurde:

Auf diesen Statistikblättern kannst du jeden einzelnen Trade sehen, der von jeder Strategie ausgelöst wurde

Auf diesen Statistikblättern kannst du jeden einzelnen Trade sehen, der von jeder Strategie ausgelöst wurde

Der exakte Markt, der exakte Einstiegskurs, der exakte Stop-Loss- und Take-Profit-Kurs, die Handelsergebnisse, alles. Das bedeutet, dass du mit Sicherheit weißt, dass die mechanischen Regeln funktionieren.

Der exakte Markt, der exakte Einstiegskurs, der exakte Stop-Loss- und Take-Profit-Kurs, die Handelsergebnisse, alles. Das bedeutet, dass du mit Sicherheit weißt, dass die mechanischen Regeln funktionieren.

(Es ist eine überprüfbare, verifizierbare, mathematische Tatsache)

(Es ist eine überprüfbare, verifizierbare, mathematische Tatsache)

Stell dir vor, dass...

Stell dir vor, dass...

Stell dir vor, du wüsstest zu hundert Prozent, dass das, was du tust, statistisch erwiesenermaßen gewinnbringend ist.

Stell dir vor, du wüsstest zu hundert Prozent, dass das, was du tust, statistisch erwiesenermaßen gewinnbringend ist.

Wie viel mehr Selbstvertrauen würde dir das geben, wenn du den Trae abfeuerst?

Wie viel mehr Selbstvertrauen würde dir das geben, wenn du den Trade abfeuerst?

Um das zu beantworten, lassen wir unsere Trader selbst zu Wort kommen...

Hermann´s Story...

Gero´s Story...

Was kommt als Nächstes?

Deinem Termin voraus:

• Your Zoom-Link Will Be Emailed To You 10 Minutes Before Your Call Is Scheduled To Start

• Please Bring A Pen And A Piece Of Paper, You'll Want To Take Notes

• Please Take The Call In A Quiet Location

- Dein Zoom-Link wird dir 10 Minuten vor Gesprächsbeginn per E-Mail zugeschickt - Bitte bring einen Stift und ein Stück Papier mit, damit du dir Notizen machen kannst - Bitte nimm das Gespräch an einem ruhigen Ort auf

We Look Forward To SpeakingWith You!

Wir freuen uns darauf, mit dir zu sprechen!

Häufig gestellte Fragen:

I’m struggling with trading around my day job and although I have a strategy, I’m not confident in it. I never know when trade setups will occur. I need a process to follow so that I can gain consistency. Can you help?

I’m struggling with trading around my day job and although I have a strategy, I’m not confident in it. I never know when trade setups will occur. I need a process to follow so that I can gain consistency. Can you help?

Absolutely. My strategies are perfect for those with day jobs as the Price Reversion and Session Momentum setups typically occur between UK 07:00 and UK 08:00. When we’ve executed, as the strategies are mechanical you’re then free to walk away, heading to work without any worry.

There’s also no trade-management required which means you’ll finally know exactly when to be at the screen and won’t ever miss a trade again, decreasing stress and increasing consistency instantly.

I’m struggling with trading around my day job and although I have a strategy, I’m not confident in it. I never know when trade setups will occur. I need a process to follow so that I can gain consistency. Can you help?

Absolutely. My strategies are perfect for those with day jobs as the Price Reversion and Session Momentum setups typically occur between UK 07:00 and UK 08:00. When we’ve executed, as the strategies are mechanical you’re then free to walk away, heading to work without any worry.

There’s also no trade-management required which means you’ll finally know exactly when to be at the screen and won’t ever miss a trade again, decreasing stress and increasing consistency instantly.

I have a strategy but I’m not sure it really works. I’ve made some money here and there but I feel like my luck will run out soon. I have no structure, no plan and no statistics to back up it’s performance and thus no confidence to execute, even when trades set up. Can you help?

It’s a common problem faced by many new traders; They may have a strategy in-place but they have no plan, no performance metrics, no statistical proof that the strategy provides edge and this means that overall they lack confidence, and confidence is critical.

If you’re lacking confidence you’re in trouble before you’ve even began, and this is before the inevitable losses that are to come if you’re trading a strategy that doesn’t work. In this situation you’re left guessing and ‘hoping’ that your strategy might work rather than knowing for sure that it does. In this situation you’re simply gambling, and we all know what happens to people who gamble… They lose all of their money.

This is exactly the problem that my strategies solve. When you join me in trading them you’ll not only receive in-detail strategy video courses that explain how and why they work, you’ll also receive my trade record showing every single trade provided by all four of the strategies as black and white proof of performance. These will allow you to look back and re-run all of the trades that each strategy has provided first-hand, showing exactly how profitable each strategy is in real-time.

With this proof in-hand , you’ll finally be able to trade with confidence from the off, again, solving the above problem entirely.

I have a strategy but I’m not sure it really works. I’ve made some money here and there but I feel like my luck will run out soon. I have no structure, no plan and no statistics to back up it’s performance and thus no confidence to execute, even when trades set up. Can you help?

It’s a common problem faced by many new traders; They may have a strategy in-place but they have no plan, no performance metrics, no statistical proof that the strategy provides edge and this means that overall they lack confidence, and confidence is critical.

If you’re lacking confidence you’re in trouble before you’ve even began, and this is before the inevitable losses that are to come if you’re trading a strategy that doesn’t work. In this situation you’re left guessing and ‘hoping’ that your strategy might work rather than knowing for sure that it does. In this situation you’re simply gambling, and we all know what happens to people who gamble… They lose all of their money.

This is exactly the problem that my strategies solve. When you join me in trading them you’ll not only receive in-detail strategy video courses that explain how and why they work, you’ll also receive my trade record showing every single trade provided by all four of the strategies as black and white proof of performance. These will allow you to look back and re-run all of the trades that each strategy has provided first-hand, showing exactly how profitable each strategy is in real-time.

With this proof in-hand , you’ll finally be able to trade with confidence from the off, again, solving the above problem entirely.

I was taught a strategy that works based on technical analysis, but I’ve realised that everyone applies this differently; Everyone draws support and resistance zones in different places, everyone uses different timeframes, everyone draws trend-lines in different places… I’m completely lost. Can you help?

I’ve been there and I know first-hand how much of a nightmare it is to have to rely on hope without any structure in-place. If you’re relying on best-guesses and ‘reading’ the market – Without years and years of chart-time behind you at a minimum – Again, you’re simply gambling and blindly hoping that you’ll achieve profitability. My strategies solve this problem as they’re built around a set of rules which remove the need to guess, predict or ‘read’ the market entirely.

These rules are proven via black and white statistics and because of this each edge is proven to provide a consistently profitable source of edge that you can implement immediately. All you’ll be doing each day is following this proven set of rules, much like myself and all of the other traders I’ve worked with do, and their results speak for themselves, as you've seen above.

I’m thinking of joining you in trading your mechanical edges, but before I decide to do so, could you share more detailed info on them for me?

Absolutely; Of the four strategies, there are two day-trade strategies, these being the Price Reversion and Session Momentum strategies, and two swing-trade strategies, these being the Higher-Timeframe Bias Bar edge and the D1 Swing edge.

My Price Reversion and Session Momentum strategies are recurring price sequences and/or structures that present a single setup at the start of every session. These setups can be carried into most markets, including currencies, indexes, stocks, etc.

To go into more detail, I noticed through nothing more complicated than looking at the charts every single day for weeks and months on end that certain price points would either attract or repel price to or away from them. When I noticed this happening extremely frequently, I built statistics on the occurrences, tested varying parameters that may allow me to profit from them, eventually was able to implement rules and from there, used this information to build both strategies.

My D1 swing edge is a completely mechanical momentum-play that I trade using a single momentum indicator alongside raw price-action, that can be applied to all markets and all timeframes. The edge works across all markets and all timeframes, and the setup is executed on using rules that entirely remove emotion from the trading process.

Within this strategy, depending on the timeframe selected and as it’s a swing strategy, positions are help from anywhere between a couple to a few days or weeks right up into the months. The strategy is designed to [almost just] run in the background. As mentioned above I usually hold positions at 1% initial risk each, keep total exposure below 25% of my total account equity and balance long-short, managing trades once a day. It’s an extremely passive and enjoyable way trade.

My Higher-Timeframe Bias Bar edge is a rule-based setup I built around one bias-bar in particular and that can be applied to all markets and all timeframes. I typically identify the bias-bar in question via a D1 timeframe which suits me best due to the very low time-commitment required, before moving down to a H1 timeframe to place an order by following my rules, before then walking away. Again, removing emotion and discretion entirely.

I trade this edge during the evenings by scanning through the major and minor currency pairs, and if I can identify a setup I place an order – Which takes no more than five minutes to do – Before then, as mentioned, walking away.

Again, as soon as we’ve executed on the setup/s, we’re then free to walk away, removing the common problem of mis-managing and tampering with positions which sabotages most new traders’ results and profitability. The strategies solve this issue entirely.

Which would be best for me?

This will depend on your time-availability. For example, if you’re busy throughout each day and cannot look at a single chart, not even via mobile, the swing-trade strategies would be best-suited to you as you’re able to trade these ‘out of hours’ in the evening, via the higher-timeframes.

If however you are able to keep an eye on the charts during the day-time, even if only for an hour or so in the morning, or an hour or so in the afternoon, you’ll be able to make use of either the day-trade or swing-trade strategies. All four of the strategies can be applied to different markets, time-zones and trading sessions i.e. London session, New York session etc, too.

Could you confirm at exactly what time you trade the four strategies each day?

Absolutely. The day-edges are traded as of the open of a trading session. As an example, if you chose to use the London session, you would begin trading as of UK 07:00. If you chose the New York session, you would begin trading as of UK 14:30. You can use any trading session that you like, irrelevant of timezone or country etc. The strategies are not timezone-dependant. In most cases, we’ve executed and walked away – Truly a mechanical, hands-off approach to the markets – Within thirty to sixty minutes or so, although in rare cases the setups do take slightly longer to present themselves.

We trade the swing-edges in the evenings, outside of the work-day, and each takes between fifteen and thirty minutes or so in regards to scanning the markets to identify the setup/s we look for, before executing and walking away. Again, as soon as we’ve executed on the setup/s, we’re then free to walk away, removing the above issue entirely.

Could you provide a real-time example?

Absolutely. As a real-time example, lets take this morning’s trades, Friday September 13th, and I’ll share exact entry time/s and exit time/s with you:

We executed at UK 07:05am via the Price Reversion edge applied to the DAX market, banking +1.8R and hitting target at UK 07:55am, within just fifty minutes. We also executed at UK 07:05am via the Session Momentum edge applied to the GBPUSD market, banking +2.5R and hitting target at UK 07:50am, within just forty five minutes. From there, we were done for the day via these strategies with just the two trades-taken with, yes, just five minutes of ‘work’, and with +4.3R banked, growing our account by +8.6% at 2% risk per-trade.

*As the strategies are mechanical and rule-based, you’re also able to fact-check the above as soon as you have the rules for either strategy as black and white proof that both took place exactly as-noted*

In regards to the Higher-Timeframe Bias Bar edge, we trade this via the D1 timeframe in most cases, and place our orders for these trades in the evening. I manually scan the markets and rarely spend more than fifteen minutes identifying opportunities and placing my orders for these trades. This can be done at anytime within the last three to four hours of the session. That said, this edge can be applied to all markets and all timeframes and can therefore be traded at any time within any given trading session, meaning it’s an extremely time-efficient approach to the markets.

In regards to the D1 Swing edge, we trade this by executing on either the open or the close of the market where we’ve identified a setup. As an example, if we’re given an entry-signal on lets say a UK equity market that opens at either the open [UK 08:00] or the close [UK 16:00] before walking away entirely.

That said, this strategy can also be applied to all markets and all timeframes and can therefore be traded at any time within any given trading session, meaning it’s another extremely time-efficient approach to the markets.

What exactly do you mean, ‘Day-Edge’ and ‘Swing-Edge’?

A day-edge is a strategy that gives us one or more setup/s per-day, and these trades in most cases resolves on the same day we take the trade. A swing-edge is a strategy that may only give us one single setup per-day, and yet this trade may take – In the case of the Higher-Timeframe Bias Bar edge – Between one or two days to a week or so to resolve, and – In the case of the D1 Swing edge – Between one or two weeks to into the months to resolve.

Which of the edges would you recommend, and why?

A great question and to answer this let me begin by explaining why I trade all four strategies combined, this being because doing so aids strategy-diversification, reducing draw-down and increasing run-up. What I mean by this is, let’s say we solely trade one edge and this strategy has a down-week or a down-month.

By only trading the one edge, we’re subjected to this draw-down, but by combining strategies and trading these across alternate uncorrelated markets we often find that where one edge under-performs, another over-performs and vice versa, reducing draw-down if not avoiding this completely, and in-turn, increasing account-growth.

This is the reason why very few professional traders only trade one edge alone. Strategy diversification is essential. To answer the question more specifically though, which strategy or strategies you choose would depend on the time you have available to trade each day, as mentioned earlier.

Are the strategies completely ‘set and forget’?

That’s correct. Each of the four strategies are completely mechanical, rule-based setups. We follow the rules to a tee and after taking each trade, we do not ‘manage’ the position. We walk away, completely removing the common problem of mis-managing and tampering with positions which sabotages most new traders’ results and profitability. The strategies solve this issue entirely.

How long will it take me to make back the money I’ll be investing in myself?

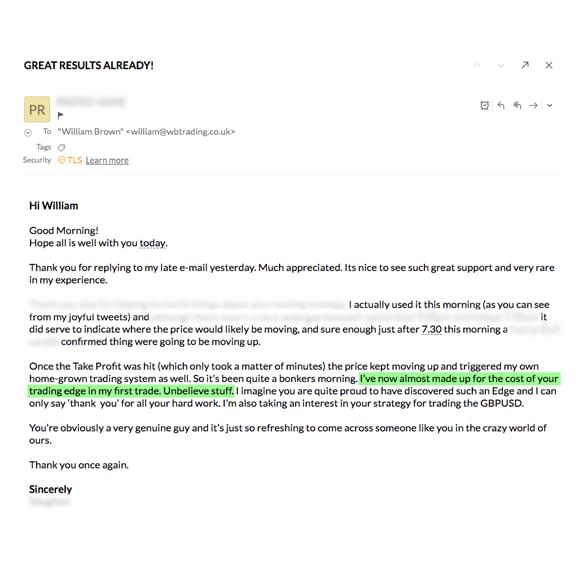

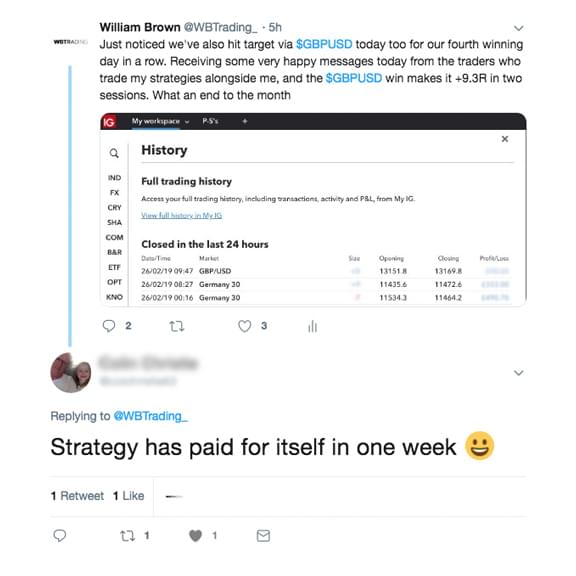

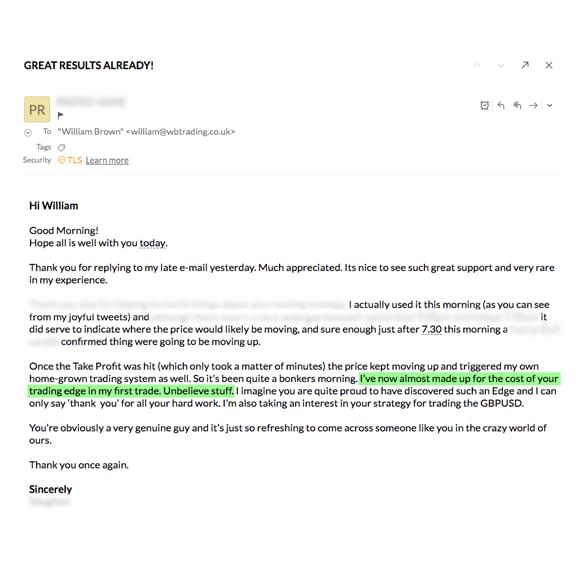

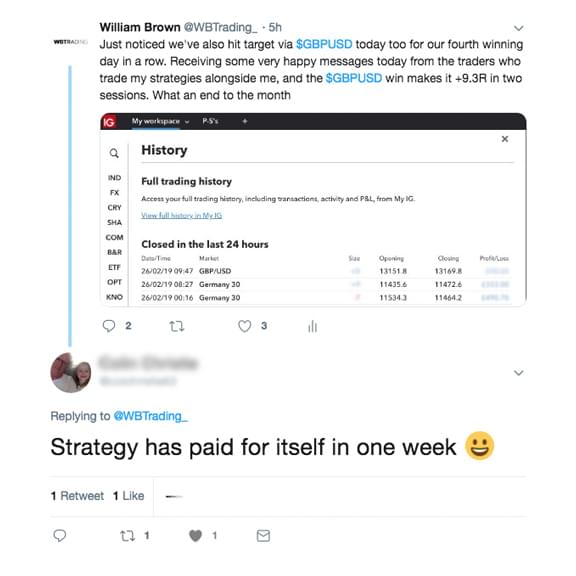

The amount of profit you’ll make on a trade-by-trade basis will be based on your account-size and the risk you place on each trade. In the past though, I’ve had traders make back the money that they invested in themselves within as little as one day, if not their very first trade…

Vau, who’s feedback is below, did just that;

Colin, who’s feedback is below, took slightly longer;

Matt, who’s feedback is below, grew his account by +9% within an hour of downloading the strategy guides and making a start;

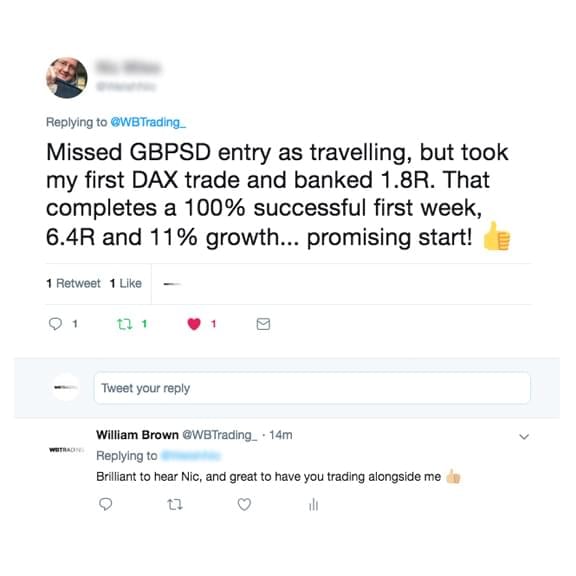

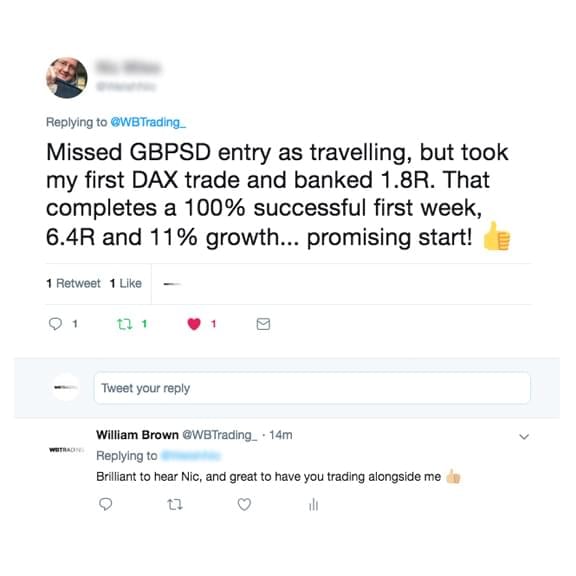

Nick, who’s feedback is below, grew his trading account by a huge +11% and +6.4R without a single losing trade on week one;

There is absolutely nothing stopping you from doing the same.

Exactly how many trades are taken via the four strategies on an average day?

Via the Session Momentum edge, we’re presented with one single setup per-day, per-market. If you choose to apply the edge to one market, you will take one trade per-day. If you choose to apply the edge to two markets, you will take two trades per-day, etc.

Via the Price Reversion edge we’re also presented with one single setup per-day, per-market, yet within this approach we’re able to decide on our level of risk-reward and how many entries we take. If you choose to apply the edge to one market, you may only take one to two entries per-day. If you choose to apply the edge to two markets, you may take three to four entries per-day, etc.

Via the D1 Swing edge we’re presented with multiple setups per-day across all markets, and we’re free to execute on as many of these as we’d like to.

Via the Higher-Timeframe Bias Bar edge we’re presented with multiple setups per-day across all markets, and we’re free to execute on as many of these as we’d like to.

I understand that the two swing strategies can be applied to all markets, but can the Price Reversion and Session Momentum strategies be applied to other markets, too?

That’s correct. Most of the traders I work with tend to select one or two markets for each and focus in on these, though the setups can certainly be used elsewhere. As an example, I’ve worked with traders who have applied the Session Momentum edge to cryptocurrencies, currency markets and even indexes, and with traders who have applied the Price Reversion edge to indexes and also currency markets, too.

It’s also not uncommon for traders to see inside my edges and the setups that I use to capitalise on these and then use this knowledge and insight to uncover their own edges and build their own strategies in the future.

Do you offer a signal service, chat-room or live-room?

I don’t offer any of these services publicly, no.

Reason being, my intention via sharing my strategies is to help you gain both profitable sources of edge that you’ll use to build your trading account, and more importantly independence, rather than leaving your trading career fully-reliant on someone else’s skillset going forward.

By learning my strategies, you’ll gain a complete understanding of the edges that I trade and with the rules in-hand all you’ll need to do is follow these, meaning you will never need to rely on someone providing trade-calls and will never be forced to sit fixed to a fast-paced live-room throughout every trading session ever again, putting you miles ahead of all the other traders who rely solely on these services immediately.

I live in [insert country]. Can your strategies be used in any country and any timezone?

That’s correct. Timezones do not affect performance or our setup/s whatsoever. We’ve worked with clients from England to Equador and from Australia to Algeria and beyond.

How difficult are the strategies to understand and use? Do I have to have trading experience to use them?

Experience certainly isn’t a requirement, no. Due to the rule-based nature of the strategies, they are therefore extremely easy to apply. We also provide a ‘Beginner’s Guide’ at no-cost within the resources of each course we offer, and your success manager, who is also available at no-cost on a lifetime-basis, is only ever an Email away if you need help or have a question.

When I’ve joined you, how long will it be before I’m able to begin placing trades?

With each individual strategy-course being roughly ninety minutes in length, you would be ready to begin placing trade/s after this time.

I’ve been scammed in the past by traders who made huge claims but didn’t deliver… What proof can you provide that your strategies genuinely perform?

I constantly strive to remain as open and transparent as possible and in an effort to do this I regularly do the following;

I physically trade my strategies live and in real-time, screen-recording myself doing so and then sharing these live-trade videos via my YouTube channel.

I regularly [and am always happy to] share my trade record/s showing genuine trades taken including exactly where we got in, where we got out, the date, the time, everything, black and white proof of performance.

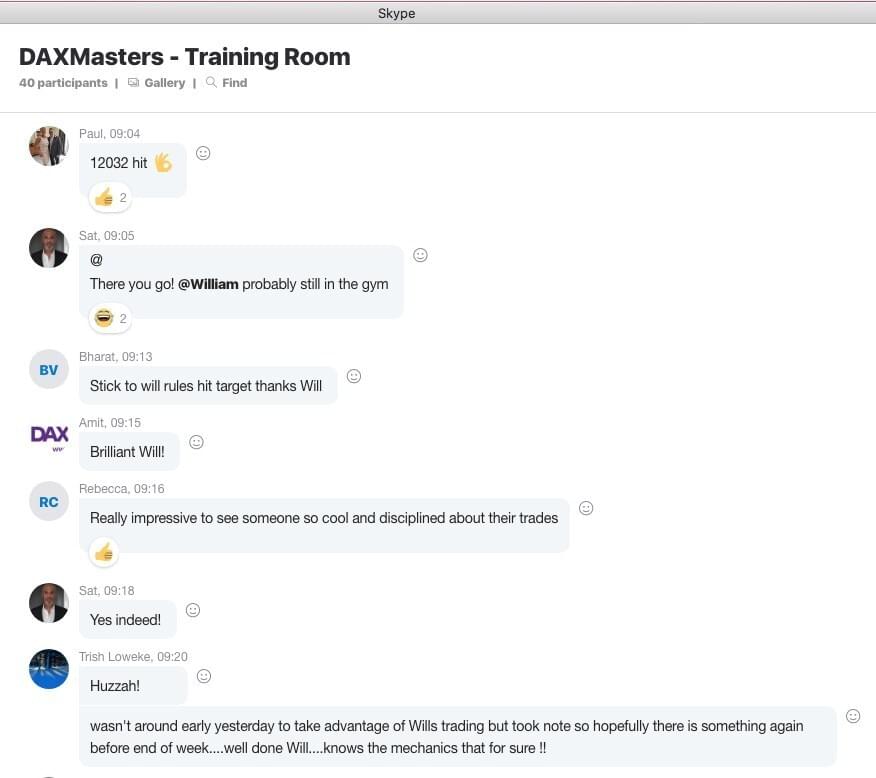

I also recently hosted the DAXMasters live-room for a week, calling my Price Reversion edge trades to room members in realtime, and I even followed this up with a blog post containing screenshots from the room itself along with mapping and outlining one of the trades that we took together.

Their feedback speaks for itself;

Where can I learn more about you William?

I’m far from famous and I’m not the type of person to brag about my possessions like others out there who try to ‘sell you the dream’ so-to-speak, though I have shared my back-story on the ‘about me’ page of this site.

I have also been featured in global publications such as Yahoo Finance, Business Insider, Influencive and International Business Times, too, who were kind enough to ask me to share my success.

If you’re such a successful trader, then why sell a course?

A great question and really, there are two answers;

Firstly, and I know this leaves me slightly vulnerable, but, loneliness. As brilliant as working for myself from home is and as much as I wouldn’t ever want to have to go back to a ‘normal’ job ever again, one thing I’ve always struggled with is the isolation and loneliness of working from home [and in my case, rarely leaving the house], that I think most people don’t see. Think about it; Outside of the work-day, and holidays-aside, how much time do you spend at home? …it’s a lot, right?

Again, I’m certainly not complaining here, but when you work from home, at least from my experience, the feeling of being ‘boxed in’ and ‘cut off’ comes around quickly, and for me at least, it was an uncomfortable realisation. I know, ‘cry me a river’ mister runs his trading business full-time from home and can more or less work when he wants, on his own terms, with no income cap etc, but that’s what initially urged me to begin social media channels like the YouTube channel.

I was building content and sharing my knowledge and strategies – Initially for free for quite a while I should add, with my initial social media followers – To almost create a small community around me to ease that ‘boxed in’ and ‘cut off’ feeling, along with contributing to other people’s growth, and doing so was one of the best decisions I ever made as I’m now able to communicate regularly with the traders I’m lucky enough to be able to work with.

Secondly, it’s simply an additional income stream that I’m sure anyone with a similar opportunity would open up for themselves. I believe anyone with a valuable skill and/or valuable knowledge should share it to help others, and charging a fee is simply an exchange of value for the time and energy it takes to create what it is that a person’s sharing.

Just like I trade my own money, just like I invest in and own properties that I rent out, just like I invest money in an index fund, just like I mentor traders one-to-one, just like I receive royalties from allowing adverts on top of my YouTube content etc. It all adds up, and as far as I’m concerned, the more income streams the better for both diversity and wealth creation.

When I enrol in your Platinum program, what happens next? What will I receive?

As soon as you're enrolled, you'll have instant access to the program contents and will receive a 'welcome' Email from me personally, where I'll also be introducing you to the team, and to your personal success manager, along with providing you with the calendar for your personal coach, so that you can book in your complimentary one-to-one call as and when you're ready.

The program is designed in a way, and in a specific video-by-video order, that will not only walk you through exactly how and why each edge works and is applied – Paired with detailed supporting statistics document inclusive of exact trades-taken with exact entry point/s, entry time/s etc, so that you’re able to re-run past trades and see the edge/s playing out in realtime – But they also cover all of the critically important elements behind successful, consistent trading:

Mindset and understanding, terminology, understanding and correctly managing risk, understanding probabilities, edge, how to build and assess trade data, plus more. Also included, as if the former aren’t enough, are our ‘trader development resources’ at no-cost. These include an in-detail training webinar that will show you exactly how I identify sources of edge and build viable, profitable strategies around these so that you can learn the skillset needed to do the same, along with an in-detail training manual on the subject of journaling, plus a copy of my trade journal that you’ll be able to print out and use.

Do you share the strategies individually?

We don’t, no. Let me explain why; Whilst we did used to do this, we found that, statistically, our most successful clients had everything we offer. All of the strategies, all of the support, everything. We have since, therefore, built-out just the one Platinum programme that we currently offer.

If I refer future clients, will I be compensated?

Absolutely. We offer a 25% referral commission on both individual products and recurring subscriptions i.e. Our ‘Inner-Circle’ coaching programme. After joining us, simply click the ‘Affiliate’ link in your account, add your PayPal account details, and copy your referral link.

When anyone who clicks this link and makes a purchase, 25% of their purchase-price will be paid in to your PayPal account immediately, automatically. If they choose a subscription service i.e. Our ‘Inner-Circle’ coaching programme, you will receive 25% of their fee every single month for as long as they are a member.

If I refer future clients, will I be compensated?

Absolutely. We offer a 25% referral commission on both individual products and recurring subscriptions i.e. Our ‘Inner-Circle’ coaching programme. After joining us, simply click the ‘Affiliate’ link in your account, add your PayPal account details, and copy your referral link.

When anyone who clicks this link and makes a purchase, 25% of their purchase-price will be paid in to your PayPal account immediately, automatically. If they choose a subscription service i.e. Our ‘Inner-Circle’ coaching programme, you will receive 25% of their fee every single month for as long as they are a member.

Are you able to recommend an appropriate starting-balance for my trading account?

Unfortunately, no. Whilst some may be comfortable starting with ‘x’, others may prefer to begin with ‘y’ and others may prefer to begin with ‘z’. This decision is entirely personal to you, your savings, your income, your circumstances, etc.

What are the ‘Trader Development Resources’ that are included in each package?

This unique additional folder of resources includes a risk-management guide in E-book format, a blank copy of a custom-built trade record, a trading journal guide in E-book format along with a template, and a training video outlining ‘how I identify edge and build viable, profitable strategies’ so that you can learn to do the same.

What account-type, if any, do I need to trade the edges?

You can use absolutely type of account to trade the edges, whether that’s a spread bet account, a contract for difference account, a direct-to-market account or a futures account.

I don’t understand how mechanical rules work. Can you explain and/or could you share a set of rules so I can better-understand?

No problem at all. Here is a video laying out a set of mechanical rules for you, along with explaining how they work and are used to trade. I’ve also walked through a trade I took last week, too:

What broker and/or software do you use?

Both myself and all of the team-members here at WBTrading use IG who provide a range of account-types from Spread Bet to Contract For Difference, etc. Charting is free. Whilst we recommend the broker based on our experience in using them, the strategies are however not broker or software-dependant whatsoever. You can use any and a change is not necessary.

Which markets can your strategies be applied to?

Whilst we have not tested every market and sector that exists for logistical reasons, we can confirm that the strategies can be applied to the majority of available markets i.e. Currencies, indexes, equities, cryptocurrencies, etc.

We have built, and continue to actively research, strategy performance across a handful of markets so that you’re aware, and have proof that represents, where each edge performs best. This saves you the time in building this data for yourself, and is included at no-cost. As is all future data.

We swallow the cost – And the hundreds upon hundreds of hours of physical work required to build this – On your behalf.

How does your guarantee work?

I also offer a 100% money-back guarantee making your purchase entirely risk-free. Simply put, the strategies are either profitable, or your money back.

Yes, you read that right.

I’m so confident that you’ll get results using the strategies that if you’ll simply take in the entirety of the course-contents, and apply them correctly across a two-quarter period whilst keeping a record of your trades, if the strategies are not profitable, then I’ll not only refund you in-full immediately, I’ll also continue to work with you and support you going forward at no extra cost.

And not just that, either. The above is in writing, too, within our ‘welcome agreement’ inside the program in contract form, meaning we are legally bound by the above. As far as I’m aware there isn’t a single other trader out there who’ll go to these lengths, but again, that’s how confident I am in what I provide.

Your success and results truly are the priority.

How many trades per-day can be taken using all four of your key strategies combined?

Due to the fact that you’re able to carry all of the strategies across multiple market/s, along with being able to carry the swing-edges across multiple timeframe/s, you’re able to take as many or as few trades as you’re comfortable with. If you would like to increase trade-frequency, you will increase the number of market/s that you trade, along with decreasing the timeframe/s you use via the swing-edges, etc.

Do your team-members also trade the startegies?

A fantastic question, and I’m proud to say that every member of the team here at WBTrading initially joined me as a paying client. This means that they are perfectly positioned to provide help within the company, along with support to you, because they have walked the walk and used the strategies to gain profitability themselves.

Across the years, I’ve formed close friendships with many of the people I’ve been lucky enough to work with and I view all clients as not just ‘clients’, but as friends. This is one of our key company values; Treating those we work with as friends, and it’s my hope that both myself and the team come across as such.

It is part of what sets us apart from other companies within the industry. We truly care about you and your results and will always go above and beyond to help you achieve success.

I’m ready to make a start. Where do I go to begin?

Great to hear. You will speak with either myself or one of our enrolment directors during your call, and from there if we feel you are a good fit for the program, we'll open up enrolment for you on the spot, along with walking you through next steps.

We look forward to working with you soon.

Which would be best for me?

This will depend on your time-availability. For example, if you’re busy throughout each day and cannot look at a single chart, not even via mobile, the swing-trade strategies would be best-suited to you as you’re able to trade these ‘out of hours’ in the evening, via the higher-timeframes.

If however you are able to keep an eye on the charts during the day-time, even if only for an hour or so in the morning, or an hour or so in the afternoon, you’ll be able to make use of either the day-trade or swing-trade strategies. All four of the strategies can be applied to different markets, time-zones and trading sessions i.e. London session, New York session etc, too.

I’ve been making all of the usual mistakes i.e. Moving my stop-loss around mid-trade, not letting trades reach target, scaling out profit with no real reason why. I’m falling prey to letting emotion rule my trading. Can you help?

Absolutely, and these are the exact issues that mechanical strategies remove entirely. By trading a mechanical, rule-based edge, emotion is removed and you’ll know exactly what to do and exactly when to do it, meaning no more guessing, no more predicting and no more needing to ‘read’ the market ever again.

In addition to this, via the supporting statistics that you’ll receive alongside the detailed strategy guide, you’ll be able to re-run past trades-taken, seeing each edge play out in realtime, which will instil the confidence needed to run trades to target. Due to this, you’ll never feel the need to tamper with a trade ever again, thus removing self-sabotaging entirely.

I’m thinking of joining you in trading your mechanical edges, but before I decide to do so, could you share more detailed info on them for me?

Absolutely; Of the four strategies, there are two day-trade strategies, these being the Price Reversion and Session Momentum strategies, and two swing-trade strategies, these being the Higher-Timeframe Bias Bar edge and the D1 Swing edge.

My Price Reversion and Session Momentum strategies are recurring price sequences and/or structures that present a single setup at the start of every session. These setups can be carried into most markets, including currencies, indexes, stocks, etc.

To go into more detail, I noticed through nothing more complicated than looking at the charts every single day for weeks and months on end that certain price points would either attract or repel price to or away from them. When I noticed this happening extremely frequently, I built statistics on the occurrences, tested varying parameters that may allow me to profit from them, eventually was able to implement rules and from there, used this information to build both strategies.

My D1 swing edge is a completely mechanical momentum-play that I trade using a single momentum indicator alongside raw price-action, that can be applied to all markets and all timeframes. The edge works across all markets and all timeframes, and the setup is executed on using rules that entirely remove emotion from the trading process.

Within this strategy, depending on the timeframe selected and as it’s a swing strategy, positions are help from anywhere between a couple to a few days or weeks right up into the months. The strategy is designed to [almost just] run in the background. As mentioned above I usually hold positions at 1% initial risk each, keep total exposure below 25% of my total account equity and balance long-short, managing trades once a day. It’s an extremely passive and enjoyable way trade.

My Higher-Timeframe Bias Bar edge is a rule-based setup I built around one bias-bar in particular and that can be applied to all markets and all timeframes. I typically identify the bias-bar in question via a D1 timeframe which suits me best due to the very low time-commitment required, before moving down to a H1 timeframe to place an order by following my rules, before then walking away. Again, removing emotion and discretion entirely.

I trade this edge during the evenings by scanning through the major and minor currency pairs, and if I can identify a setup I place an order – Which takes no more than five minutes to do – Before then, as mentioned, walking away.

Again, as soon as we’ve executed on the setup/s, we’re then free to walk away, removing the common problem of mis-managing and tampering with positions which sabotages most new traders’ results and profitability. The strategies solve this issue entirely.

Which would be best for me?

This will depend on your time-availability.

If you’re busy throughout each day and cannot look at a single chart, not even via mobile, the swing-trade strategies would be best-suited to you as you’re able to trade these ‘out of hours’ in the evening, via the higher-timeframes.

If however you are able to keep an eye on the charts during the day-time, even if only for an hour or so in the morning, or an hour or so in the afternoon, you’ll be able to make use of either the day-trade or swing-trade strategies.

All four of the strategies can be applied to different markets, time-zones and trading sessions i.e. London session, New York session etc, too.

Frequently Asked Questions:

I’m struggling with trading around my day job and although I have a strategy, I’m not confident in it. I never know when trade setups will occur. I need a process to follow so that I can gain consistency. Can you help?

Absolutely. My strategies are perfect for those with day jobs as the Price Reversion and Session Momentum setups typically occur between UK 07:00 and UK 08:00. When we’ve executed, as the strategies are mechanical you’re then free to walk away, heading to work without any worry.

There’s also no trade-management required which means you’ll finally know exactly when to be at the screen and won’t ever miss a trade again, decreasing stress and increasing consistency instantly.

I have a strategy but I’m not sure it really works. I’ve made some money here and there but I feel like my luck will run out soon. I have no structure, no plan and no statistics to back up it’s performance and thus no confidence to execute, even when trades set up. Can you help?

It’s a common problem faced by many new traders; They may have a strategy in-place but they have no plan, no performance metrics, no statistical proof that the strategy provides edge and this means that overall they lack confidence, and confidence is critical.

If you’re lacking confidence you’re in trouble before you’ve even began, and this is before the inevitable losses that are to come if you’re trading a strategy that doesn’t work. In this situation you’re left guessing and ‘hoping’ that your strategy might work rather than knowing for sure that it does. In this situation you’re simply gambling, and we all know what happens to people who gamble… They lose all of their money.

This is exactly the problem that my strategies solve. When you join me in trading them you’ll not only receive in-detail strategy video courses that explain how and why they work, you’ll also receive my trade record showing every single trade provided by all four of the strategies as black and white proof of performance. These will allow you to look back and re-run all of the trades that each strategy has provided first-hand, showing exactly how profitable each strategy is in real-time.

With this proof in-hand , you’ll finally be able to trade with confidence from the off, again, solving the above problem entirely.

I was taught a strategy that works based on technical analysis, but I’ve realised that everyone applies this differently; Everyone draws support and resistance zones in different places, everyone uses different timeframes, everyone draws trend-lines in different places… I’m completely lost. Can you help?

I’ve been there and I know first-hand how much of a nightmare it is to have to rely on hope without any structure in-place. If you’re relying on best-guesses and ‘reading’ the market – Without years and years of chart-time behind you at a minimum – Again, you’re simply gambling and blindly hoping that you’ll achieve profitability. My strategies solve this problem as they’re built around a set of rules which remove the need to guess, predict or ‘read’ the market entirely.

These rules are proven via black and white statistics and because of this each edge is proven to provide a consistently profitable source of edge that you can implement immediately. All you’ll be doing each day is following this proven set of rules, much like myself and all of the other traders I’ve worked with do, and their results speak for themselves, as you've seen above.

I’m thinking of joining you in trading your mechanical edges, but before I decide to do so, could you share more detailed info on them for me?

Absolutely; Of the four strategies, there are two day-trade strategies, these being the Price Reversion and Session Momentum strategies, and two swing-trade strategies, these being the Higher-Timeframe Bias Bar edge and the D1 Swing edge.

My Price Reversion and Session Momentum strategies are recurring price sequences and/or structures that present a single setup at the start of every session. These setups can be carried into most markets, including currencies, indexes, stocks, etc.

To go into more detail, I noticed through nothing more complicated than looking at the charts every single day for weeks and months on end that certain price points would either attract or repel price to or away from them. When I noticed this happening extremely frequently, I built statistics on the occurrences, tested varying parameters that may allow me to profit from them, eventually was able to implement rules and from there, used this information to build both strategies.

My D1 swing edge is a completely mechanical momentum-play that I trade using a single momentum indicator alongside raw price-action, that can be applied to all markets and all timeframes. The edge works across all markets and all timeframes, and the setup is executed on using rules that entirely remove emotion from the trading process.

Within this strategy, depending on the timeframe selected and as it’s a swing strategy, positions are help from anywhere between a couple to a few days or weeks right up into the months. The strategy is designed to [almost just] run in the background. As mentioned above I usually hold positions at 1% initial risk each, keep total exposure below 25% of my total account equity and balance long-short, managing trades once a day. It’s an extremely passive and enjoyable way trade.

My Higher-Timeframe Bias Bar edge is a rule-based setup I built around one bias-bar in particular and that can be applied to all markets and all timeframes. I typically identify the bias-bar in question via a D1 timeframe which suits me best due to the very low time-commitment required, before moving down to a H1 timeframe to place an order by following my rules, before then walking away. Again, removing emotion and discretion entirely.

I trade this edge during the evenings by scanning through the major and minor currency pairs, and if I can identify a setup I place an order – Which takes no more than five minutes to do – Before then, as mentioned, walking away.

Again, as soon as we’ve executed on the setup/s, we’re then free to walk away, removing the common problem of mis-managing and tampering with positions which sabotages most new traders’ results and profitability. The strategies solve this issue entirely.

Which would be best for me?

This will depend on your time-availability. For example, if you’re busy throughout each day and cannot look at a single chart, not even via mobile, the swing-trade strategies would be best-suited to you as you’re able to trade these ‘out of hours’ in the evening, via the higher-timeframes.

If however you are able to keep an eye on the charts during the day-time, even if only for an hour or so in the morning, or an hour or so in the afternoon, you’ll be able to make use of either the day-trade or swing-trade strategies. All four of the strategies can be applied to different markets, time-zones and trading sessions i.e. London session, New York session etc, too.

Could you confirm at exactly what time you trade the four strategies each day?

Absolutely. The day-edges are traded as of the open of a trading session. As an example, if you chose to use the London session, you would begin trading as of UK 07:00. If you chose the New York session, you would begin trading as of UK 14:30. You can use any trading session that you like, irrelevant of timezone or country etc. The strategies are not timezone-dependant. In most cases, we’ve executed and walked away – Truly a mechanical, hands-off approach to the markets – Within thirty to sixty minutes or so, although in rare cases the setups do take slightly longer to present themselves.

We trade the swing-edges in the evenings, outside of the work-day, and each takes between fifteen and thirty minutes or so in regards to scanning the markets to identify the setup/s we look for, before executing and walking away. Again, as soon as we’ve executed on the setup/s, we’re then free to walk away, removing the above issue entirely.

Could you provide a real-time example?

Absolutely. As a real-time example, lets take this morning’s trades, Friday September 13th, and I’ll share exact entry time/s and exit time/s with you:

We executed at UK 07:05am via the Price Reversion edge applied to the DAX market, banking +1.8R and hitting target at UK 07:55am, within just fifty minutes. We also executed at UK 07:05am via the Session Momentum edge applied to the GBPUSD market, banking +2.5R and hitting target at UK 07:50am, within just forty five minutes. From there, we were done for the day via these strategies with just the two trades-taken with, yes, just five minutes of ‘work’, and with +4.3R banked, growing our account by +8.6% at 2% risk per-trade.

*As the strategies are mechanical and rule-based, you’re also able to fact-check the above as soon as you have the rules for either strategy as black and white proof that both took place exactly as-noted*

In regards to the Higher-Timeframe Bias Bar edge, we trade this via the D1 timeframe in most cases, and place our orders for these trades in the evening. I manually scan the markets and rarely spend more than fifteen minutes identifying opportunities and placing my orders for these trades. This can be done at anytime within the last three to four hours of the session. That said, this edge can be applied to all markets and all timeframes and can therefore be traded at any time within any given trading session, meaning it’s an extremely time-efficient approach to the markets.

In regards to the D1 Swing edge, we trade this by executing on either the open or the close of the market where we’ve identified a setup. As an example, if we’re given an entry-signal on lets say a UK equity market that opens at either the open [UK 08:00] or the close [UK 16:00] before walking away entirely.

That said, this strategy can also be applied to all markets and all timeframes and can therefore be traded at any time within any given trading session, meaning it’s another extremely time-efficient approach to the markets.

What exactly do you mean, ‘Day-Edge’ and ‘Swing-Edge’?

A day-edge is a strategy that gives us one or more setup/s per-day, and these trades in most cases resolves on the same day we take the trade. A swing-edge is a strategy that may only give us one single setup per-day, and yet this trade may take – In the case of the Higher-Timeframe Bias Bar edge – Between one or two days to a week or so to resolve, and – In the case of the D1 Swing edge – Between one or two weeks to into the months to resolve.

Which of the edges would you recommend, and why?

A great question and to answer this let me begin by explaining why I trade all four strategies combined, this being because doing so aids strategy-diversification, reducing draw-down and increasing run-up. What I mean by this is, let’s say we solely trade one edge and this strategy has a down-week or a down-month.

By only trading the one edge, we’re subjected to this draw-down, but by combining strategies and trading these across alternate uncorrelated markets we often find that where one edge under-performs, another over-performs and vice versa, reducing draw-down if not avoiding this completely, and in-turn, increasing account-growth.

This is the reason why very few professional traders only trade one edge alone. Strategy diversification is essential. To answer the question more specifically though, which strategy or strategies you choose would depend on the time you have available to trade each day, as mentioned earlier.

Are the strategies completely ‘set and forget’?

That’s correct. Each of the four strategies are completely mechanical, rule-based setups. We follow the rules to a tee and after taking each trade, we do not ‘manage’ the position. We walk away, completely removing the common problem of mis-managing and tampering with positions which sabotages most new traders’ results and profitability. The strategies solve this issue entirely.

How long will it take me to make back the money I’ll be investing in myself?

The amount of profit you’ll make on a trade-by-trade basis will be based on your account-size and the risk you place on each trade. In the past though, I’ve had traders make back the money that they invested in themselves within as little as one day, if not their very first trade…

Vau, who’s feedback is below, did just that;

Colin, who’s feedback is below, took slightly longer;

Matt, who’s feedback is below, grew his account by +9% within an hour of downloading the strategy guides and making a start;

Nick, who’s feedback is below, grew his trading account by a huge +11% and +6.4R without a single losing trade on week one;

There is absolutely nothing stopping you from doing the same.

Exactly how many trades are taken via the four strategies on an average day?

Via the Session Momentum edge, we’re presented with one single setup per-day, per-market. If you choose to apply the edge to one market, you will take one trade per-day. If you choose to apply the edge to two markets, you will take two trades per-day, etc.

Via the Price Reversion edge we’re also presented with one single setup per-day, per-market, yet within this approach we’re able to decide on our level of risk-reward and how many entries we take. If you choose to apply the edge to one market, you may only take one to two entries per-day. If you choose to apply the edge to two markets, you may take three to four entries per-day, etc.

Via the D1 Swing edge we’re presented with multiple setups per-day across all markets, and we’re free to execute on as many of these as we’d like to.

Via the Higher-Timeframe Bias Bar edge we’re presented with multiple setups per-day across all markets, and we’re free to execute on as many of these as we’d like to.

I understand that the two swing strategies can be applied to all markets, but can the Price Reversion and Session Momentum strategies be applied to other markets, too?

That’s correct. Most of the traders I work with tend to select one or two markets for each and focus in on these, though the setups can certainly be used elsewhere. As an example, I’ve worked with traders who have applied the Session Momentum edge to cryptocurrencies, currency markets and even indexes, and with traders who have applied the Price Reversion edge to indexes and also currency markets, too.

It’s also not uncommon for traders to see inside my edges and the setups that I use to capitalise on these and then use this knowledge and insight to uncover their own edges and build their own strategies in the future.

Do you offer a signal service, chat-room or live-room?

I don’t offer any of these services publicly, no.

Reason being, my intention via sharing my strategies is to help you gain both profitable sources of edge that you’ll use to build your trading account, and more importantly independence, rather than leaving your trading career fully-reliant on someone else’s skillset going forward.

By learning my strategies, you’ll gain a complete understanding of the edges that I trade and with the rules in-hand all you’ll need to do is follow these, meaning you will never need to rely on someone providing trade-calls and will never be forced to sit fixed to a fast-paced live-room throughout every trading session ever again, putting you miles ahead of all the other traders who rely solely on these services immediately.

I live in [insert country]. Can your strategies be used in any country and any timezone?

That’s correct. Timezones do not affect performance or our setup/s whatsoever. We’ve worked with clients from England to Equador and from Australia to Algeria and beyond.

How difficult are the strategies to understand and use? Do I have to have trading experience to use them?

Experience certainly isn’t a requirement, no. Due to the rule-based nature of the strategies, they are therefore extremely easy to apply. We also provide a ‘Beginner’s Guide’ at no-cost within the resources of each course we offer, and your success manager, who is also available at no-cost on a lifetime-basis, is only ever an Email away if you need help or have a question.

When I’ve joined you, how long will it be before I’m able to begin placing trades?

With each individual strategy-course being roughly ninety minutes in length, you would be ready to begin placing trade/s after this time.

I’ve been scammed in the past by traders who made huge claims but didn’t deliver… What proof can you provide that your strategies genuinely perform?

I constantly strive to remain as open and transparent as possible and in an effort to do this I regularly do the following;

I physically trade my strategies live and in real-time, screen-recording myself doing so and then sharing these live-trade videos via my YouTube channel.

I regularly [and am always happy to] share my trade record/s showing genuine trades taken including exactly where we got in, where we got out, the date, the time, everything, black and white proof of performance.

I also recently hosted the DAXMasters live-room for a week, calling my Price Reversion edge trades to room members in realtime, and I even followed this up with a blog post containing screenshots from the room itself along with mapping and outlining one of the trades that we took together.

Their feedback speaks for itself;